There are so many benefits to owning a house.* Home ownership brings a lot of freedom that you don’t necessarily have when you rent. For me, one of the biggest advantages of owning a home is having the liberty to completely transform our space. Other advantages we enjoy are certain tax benefits, belonging to a tight neighborhood community, and building equity.

Aside from having your very own place to plant roots, the biggest advantage to owning a house is not paying your landlord’s mortgage. What do I mean by that? Living in an apartment (or renting a house) means you pay a monthly fee to stay a landlord’s residence. Your landlord will then use your rent to pay down the mortgage on the property you live in, therefore building equity in that property.

When you purchase a house you are making a smart investment. According to this recent article; “unlike renters, homeowners build equity over time. On most mortgages, a portion of each monthly payment goes toward the loan’s interest. The remainder pays down its principal. (Your lender’s amortization schedule shows the exact proportions, which change over time, for each month’s payment.) Every dollar you put toward your loan’s principal represents a dollar of equity – actual ownership of the property.”

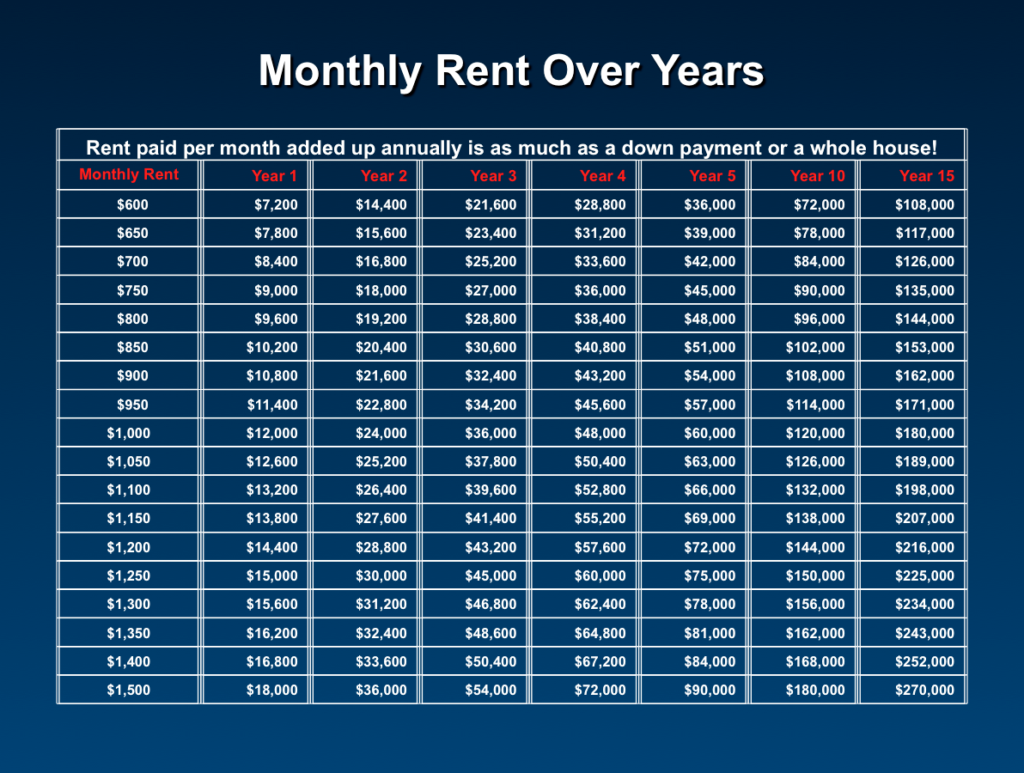

Take a look at the chart below. You can quickly add up how much can be spent on rent per year. The sum of rent spent over 1-5 years and beyond if saved, could be used as a down payment. In some cases if you have been renting for 5 or more years, you could have purchased a small house by now.

Of course there are benefits to renting too. There are so many reasons why someone would rent as opposed to owning a house. Brandon and I rented an apartment for over 3 years before we bought our house. When you rent, you have no responsibility to maintain the building. It’s incredibly convenient. Renting is great if you aren’t sure how long you want to live in an area before relocating. Many landlords will even include utility costs in the rent which is one less thing to pay every month. There is less risk involved when you rent. It’s a trade off.

Renting an apartment is a great for a short term. However, purchasing a house will more than likely benefit you long term because home ownership yields a return on your investment. If you aren’t sure you’re ready to buy a house, talk to your financial advisor before taking the the next step.

* Disclaimer: This article is for entertainment purposes only. Credit is given to the authors of articles that are quoted when the original author is known. Information on this site is solely for entertainment, and should not be substituted for legal, financial or tax advice. By entering this site you agree to be responsible for actions you take without proper financial, legal or tax advice.